Understanding your Patient's Insurance

Estimated read time: 15 minutes

Understanding Insurance at Nourish: A Guide for Providers

At Nourish, our mission is to help patients live healthier, longer lives - and that starts with making care accessible. We partner with major insurers, enabling patients to receive high-quality nutrition care with minimal out-of-pocket costs - 94% of patients pay $0.

Our Billing Specialists help patients maximize their insurance benefits. Still, patients might have questions during sessions. This guide is designed to help you confidently respond to general insurance inquiries. If you're ever uncertain, don't hesitate to refer your patient to support@usenourish.com for additional support.

How Insurance Works at Nourish

Patient Signup and Insurance Information

When patients sign up through our online portal, they enter their insurance information as part of the process to be matched with a dietitian and schedule their first session. This information helps us estimate their coverage and limits.

Coverage Calculator

Our Coverage Calculator provides an estimate of a patient’s insurance benefits. It is highly accurate, but please note that insurance companies may occasionally process claims differently than expected.

The Nourish Guarantee

To ensure peace of mind, we offer the Nourish Guarantee, our commitment to providing a no-surprise billing experience for patients! Our guarantee is:

If a claim gets denied, we won't charge the patient for any appointments that have already occurred. They'll get those appointments for free.

If the appointment has a copay or coinsurance, the patient will not be charged more than the initial estimate for any appointments they've had until we learn their real cost. Once we learn the actual copay or coinsurance, patients will be immediately notified over email. For future appointments afterwards, patients will be charged the full copay or coinsurance amount.

If the appointment goes towards a deductible, we'll offer patients two options for any appointments that already took place until that point:

Either pay the deductible for all prior appointments, including the initial session, and keep doing appointments covered by insurance, or

Choose to not pay it and we won’t charge patients for prior appointments. For any future appointments, patients will need to pay out-of-pocket.

Because patients don’t have to worry about unexpected charges, we encourage providers to schedule weekly recurring appointments during the initial visit. This helps secure consistent and convenient times for you and your patients.

Submitting and Processing Claims

As a provider, your role in the insurance process is simple. Within 48 hours after a session, you need to:

Mark the appointment status and duration in the Provider Portal.

Complete, sign, and lock the patient’s chart note.

Once these steps are done, our Billing Team takes over to submit the claim to the insurance company. While processing times vary, most claims are resolved within 2 to 3 weeks.

Accessing Billing Information

For Patients

After claims are processed, patients receive email notifications with details of their coverage. They can log in to their Patient Portal and visit the Billing & Insurance tab to view insurance coverage details, claim statuses, payment history, and payment methods.

The video below provides an overview of the Billing & Insurance tab in the Patient Portal.

For Providers

You can also access this billing information through your Provider Portal by navigating to the patient’s profile and selecting the Billing & Insurance tab. This feature helps you support patients by answering basic insurance questions during sessions.

RD Insurance FAQs

Do I need to be credentialed with Nourish to provide in-network care?

We have processes in place so that you can provide in-network care to patients starting on day 1, even if your individual credentialing with Nourish is not yet complete. Please be sure to complete the tasks outlined within your Credentialing Checklist in your first 30 days so that our Credentialing Team can submit your applications in a timely manner.

Which insurances do we accept?

Aetna (including Meritain)

Blue Cross Blue Shield (BCBS) and all affiliates (such as Anthem, BCBS of any state, Independence, Capital, Highmark, etc.)

Cigna

Devoted Health

Medical Mutual of Ohio

United Healthcare (UHC) and all affiliates (UMR, Student Resources, Oxford, etc.)

Medicare (but only with a formal diagnosis of Diabetes (Type 1 or Type 2) or Chronic Kidney Disease). This includes Medicare Advantage plans hosted through commercial insurance, like AARP Medicare Advantage, Aetna Medicare, etc.

Do we accept Medicare or Medicaid?

We accept Medicare! But the client will only be covered if they have a formal diagnosis on record of Diabetes or Chronic Kidney Disease. Any other diagnoses (including prediabetes, eating disorders, etc.) are not covered, and Medicare does not make any exceptions.

We do not accept Medicaid in any form at this time.

What if a client is on their parents' / spouse’s / etc. insurance?

Totally fine! We still accept it. We will make sure to bill it accordingly.

What if a client changes insurance while you are working together?

Again, totally fine! We will run the new insurance. Please note that if a client of yours switches to Medicare, they will only be covered if they have a Diabetes or Chronic Kidney Disease diagnosis, as mentioned above.

My patient is telling me they see a $200-$ 500 charge from their insurance company for a single appointment. Do they owe that?”

Nourish does bill $200 - 500 based on our rate contracted with insurance, although we get paid much, much less than that (this is just how we have to bill to be compliant with the contracts). Patients are never responsible for paying for denials (with the only exception being if they did not have active insurance upfront), so patients will never owe $200 - 500 for an appointment! Unfortunately we have no control over patients’ insurance showing the 'you may owe $200 - 500 message' on Explanation of Benefits (EOB) forms - we would get rid of it if we could!

What is our self-pay rate, and how does it work?

Our self-pay rate is $145 per session. Self-pay clients are charged the day after their appointment.

Do we offer sliding scale appointments for self-pay clients?

We offer a limited amount of sliding scale spots for our clients most in-need. If you want to request a sliding scale rate for a client of yours, please email support@usenourish.com. Please note that we have very limited spots open (only 1 per RD as a rule of thumb).

What is our no-show rate, and how does it work?

Our no-show fee is $75, and includes any appointment late-cancelled or missed where the no-show fee was not waived.

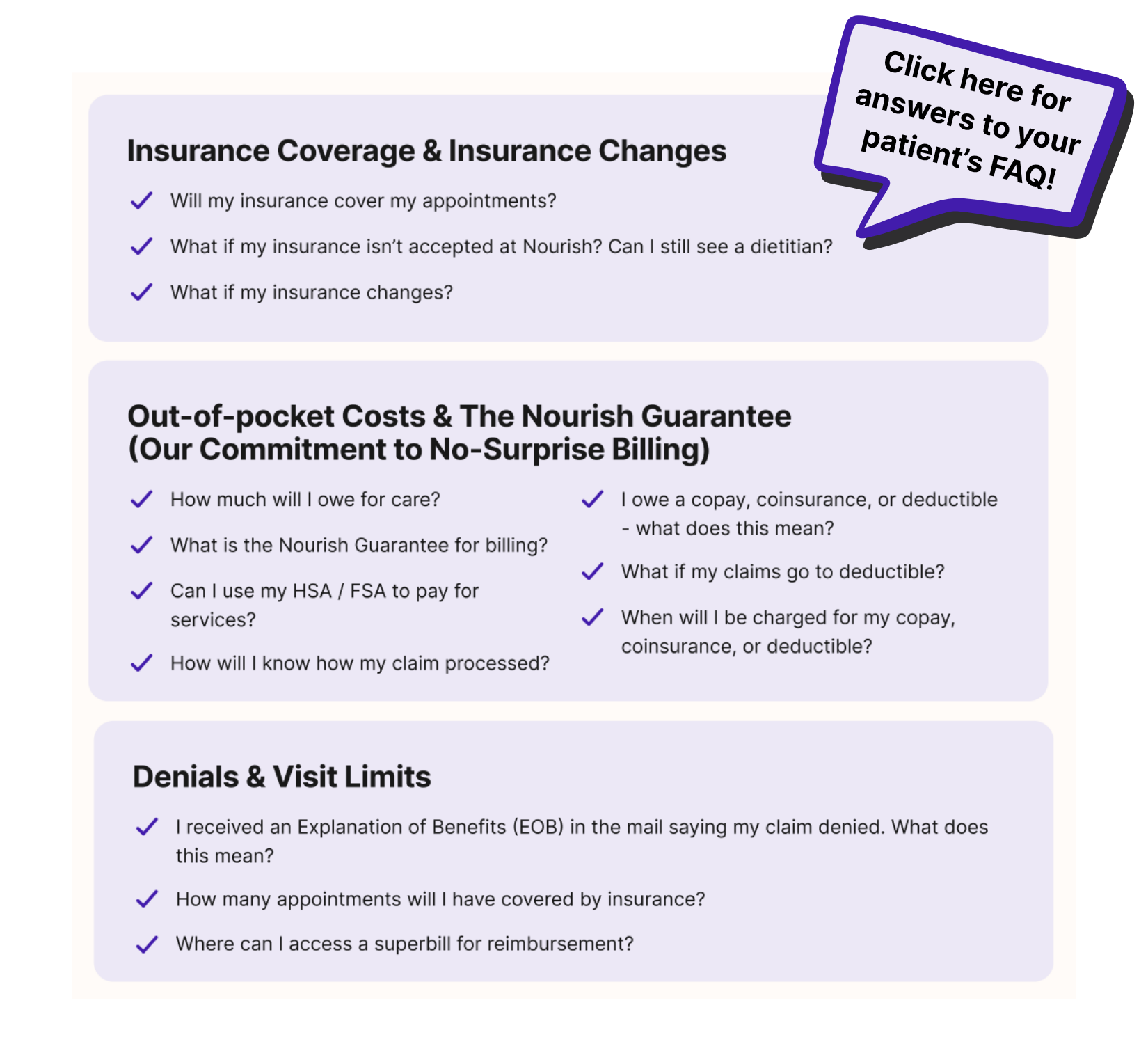

Patient Insurance FAQs

Attached is a helpful guide for supporting your patients with general insurance inquiries.

Use the following templates to answer patients' insurance questions:

How many visits will my insurance cover?

While most patients have unlimited visits, you can confirm your visit limits by calling the member services number on the back of your insurance card and asking for Medical Nutrition Therapy benefits.

How long will it take for my insurance claim to be processed?

Insurance claims typically take at least 2-3 weeks to process. Once Nourish gets your first claim back from insurance, you'll be notified of the outcome. The claim status for each of your appointments can be found in your Patient Portal on the 'Billing & Insurance' tab. No matter the outcome, all of your appointments are backed by the Nourish Guarantee, so you will never receive a surprise bill.

In the meantime, you can use our Coverage Calculator to receive an insurance estimate. If you want more information, you can call the phone number on the back of your insurance card to ask about your coverage for Medical Nutrition Therapy.

What happens if my insurance claim is denied?

If your insurance denies payment, Nourish will not charge you for any appointments that have occurred, as long as you had active coverage at that time. We will reach out to you personally to determine payment options for future appointments if you wish to continue working together.